A Deeper Look Into the Core Technology Behind Blockchain

Article by The Crypto Barista | Edited by Trewkat and Rianz | Cover by pub-gmn.eth

This is our first article in Bankless Publishing’s new Crypto Basics Series. We’ll be shipping all of our introductory web3 content on Mirror each Monday, enabling users to curate a web3 reference library by minting NFTs on Optimism.

The terms ‘blockchain’ and ‘distributed ledger technology’ (DLT) may be widely used but are not always well understood. This article explains the differences between them. Rather than covering the technical aspects in depth, we will focus on how and why these technologies have the potential to disrupt existing business models and perhaps even create entirely new ones.

Blockchain first started to gain serious recognition after ‘Satoshi Nakamoto’ authored the Bitcoin White Paper in 2008. In this paper Nakamoto describes how he used DLT to create a payment system designed to be: open, decentralized, and censorship resistant. The end result was bitcoin — a digital representation of value which cannot be copied, and does not rely on any single intermediary to exist. The ability to create uniqueness in the digital world has provided a means to represent any asset in a digital form on a distributed ledger. While the best known and first use cases of this are cryptocurrencies, the underlying concept is now being used to create digital securities, artwork, and more. DLT has the potential to make the creation, transfer, and settlement of assets a lot more efficient.

But what exactly is a DLT, and why are the terms ‘DLT’ and ‘blockchain’ often used interchangeably, even though they are not synonymous? Let’s start by explaining DLT.

What Is Distributed Ledger Technology (DLT)?

In simple terms, DLT is nothing more than a distributed database. A set of computers — often called nodes — are connected peer-to-peer in a network, enabling direct, bilateral sharing of data.

In a DLT system, data are copied across multiple nodes on the network, ensuring resiliency and eliminating the need to rely on a central node for data verification or execution. DLTs use a consensus mechanism to add new data to the ledger in a trusted, secure, and verifiable way. The algorithm ensures new data entries are validated, and only added to the ledger if consensus is reached amongst the nodes or participants. You might have heard of proof-of-work (often referred to as ‘mining’), which is the system currently used by the Bitcoin and Ethereum networks, but many other consensus mechanisms also exist.

A DLT network is quite different from a traditional centralised set up, which relies on all participants connecting to a central computer (or set of computers) thus creating a single point of failure. If anything happens to the central operator, the entire network is at risk of collapsing. Centralised networks also require complete trust in the central node as data gets reconciled against this single version of the truth. Solving these vulnerabilities is the core value proposition of a DLT.

One drawback of DLT systems is that recording data is often slower, as the network needs to agree on the validity of new entries (via execution of the consensus mechanism). In addition, governance of DLTs can be complex as participants need to establish a fair system that outlines, for example, how protocol upgrades and other changes are to be implemented.

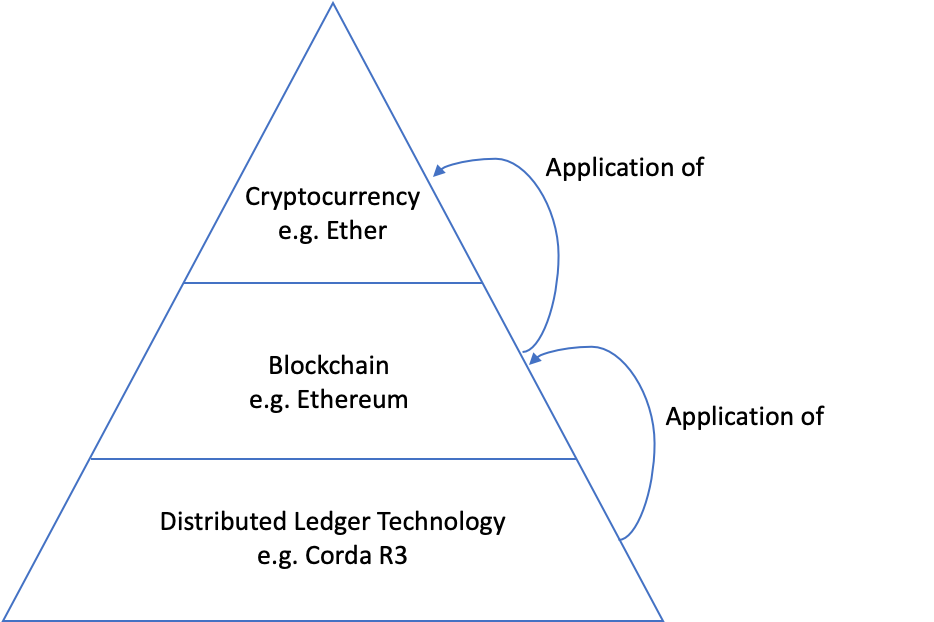

Blockchain Is an Application of DLT

Blockchain is a specific type of DLT with certain, distinct characteristics.

All blockchains are DLTs but not all DLTs are blockchains.

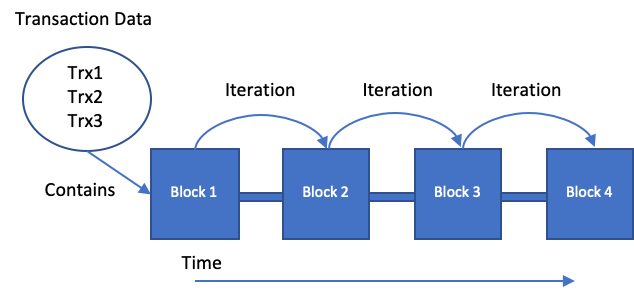

Blockchains always record data in chronological order — starting with the first transaction and progressing to the most recent transaction. Data are grouped into blocks, and blocks are sequenced to form a chain of linked blocks. Each block has a maximum size and they are created in intervals of time. The Bitcoin ledger, for example, mints a block every 10 minutes. The consensus mechanism mentioned earlier ensures new blocks being added have been verified and are recognized as truthful or valid by the network.

Cryptography is used to ensure integrity of the chain; the chain can be verified at each point in time, and changing the historic state of the blockchain is impossible without breaking the linkage between the blocks. The historic state is considered immutable; once a transaction has been included in a block it cannot be altered and remains recorded on the chain forever.

It is important to understand that DLT systems do not have to follow the same rules of chronological transactions or immutability that blockchains do. DLT systems can be designed to have the option of erasing data, or storing data in different formats and intervals, enabling them to be tailored to the specific requirements of a particular use case.

Open architecture is another important characteristic of blockchains. Most blockchain implementations allow any user to set up a node and join the network. Users have the option to download a copy of the entire transaction history and participate in the validation process. The Bitcoin and Ethereum networks are good examples of open blockchains; all transaction data is available to the public, and joining the network is open to anyone.

Not all DLT systems adhere to such an open architecture; private networks or permissioned networks can restrict access to data or participation. For example, SDX is a DLT-based exchange owned by the Swiss stock exchange. The network runs on R3 Corda technology and is only accessible by banks and other financial industry participants. As all participants are known to each other, and have been approved before onboarding, a certain level of trust exists among the members. This has implications for the architecture of the consensus algorithm: participants are more willing to prioritize scalability and security over a high degree of decentralization.

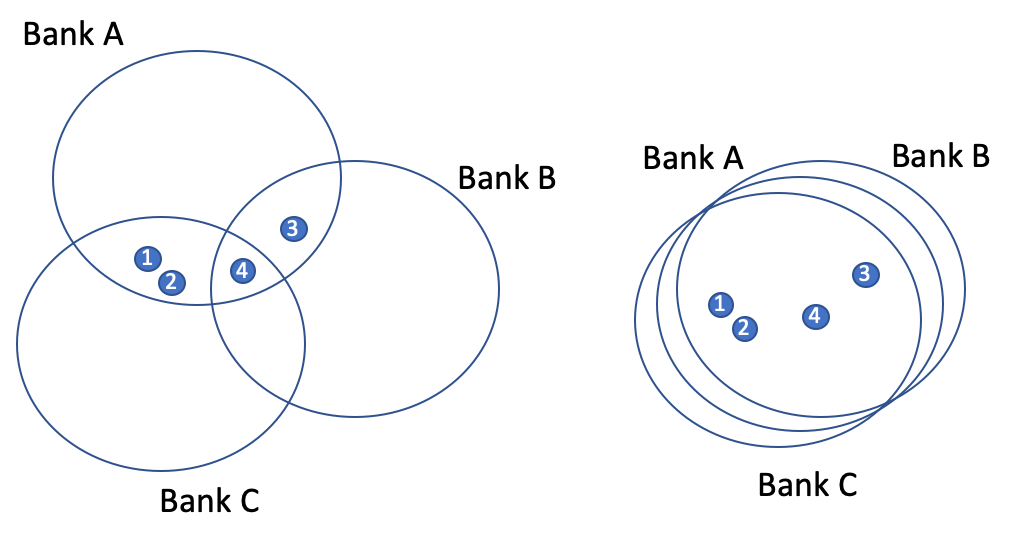

DTLs also enable data to be shared between a subset of participants as opposed to the entire network. If Bank A and Bank B decide to engage in a transaction, the transaction data can be hidden from other participants on the network, enabling transaction privacy.

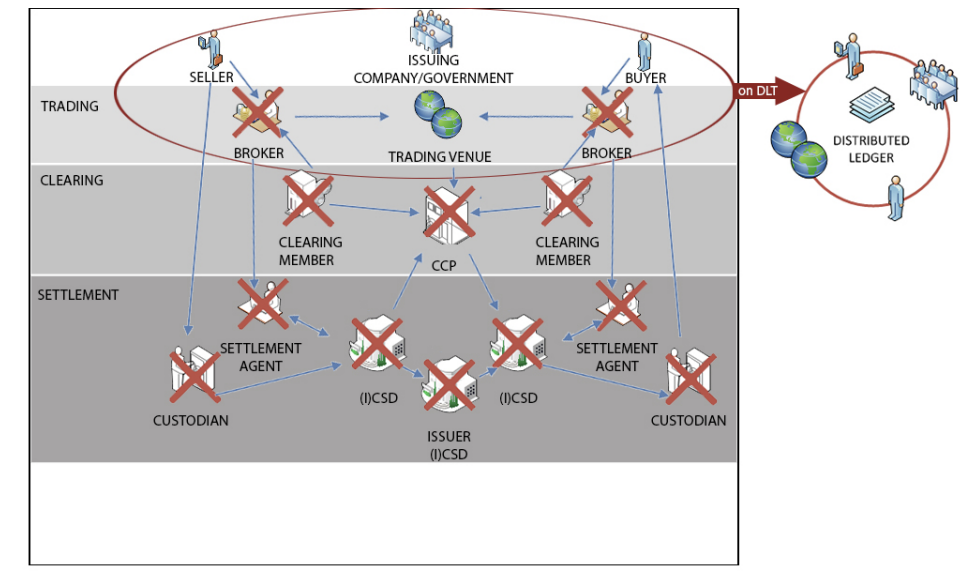

DLT Networks Remove the Need for the Middleman

Once participants are connected via a DLT network and can engage in peer-to-peer (P2P) transactions, the need for intermediaries (or ‘middlemen’) ceases to exist.

Therefore, business models that rely on charging fees for processing transactions, or acting as a trusted party (to settle between two counter-parties) are most at risk of being made increasingly redundant by distributed ledger technology.

Business models that rely on charging fees for processing transactions are most at risk of being made redundant by distributed ledger technology.

– The Crypto Barista

Some crypto economists have estimated that “about 35% of U.S. employment is related to activity aimed at upholding trustful economic relationships” which extrapolates to a global figure of 29 trillion USD to represent the cost of achieving trust.

One example is the current security settlement system. Consider the diagram below published by the European Central Bank. It provides a good illustration of just how many counter-parties could be disintermediated by adopting a DLT system. By making intermediary roles redundant, the whole ecosystem becomes much more efficient, less risky, and cheaper — which ultimately benefits both buyers and sellers.

You can also apply the same logic to other parts of the economy and notice the impacts. For example, platforms such as Uber or Amazon, which make a living by charging a fee for matching buyers (passengers or shoppers) with sellers (taxi drivers or goods producers), could be at risk of being replaced by a DLT-based marketplace.

Open Blockchains Take the Potential One Step Further

Have you ever wondered why, or been frustrated by, the fact that you can’t send messages from one messenger app to another? Wouldn’t it be great if you could have freedom of choice across platforms, just like you do with browsers for exploring the web?

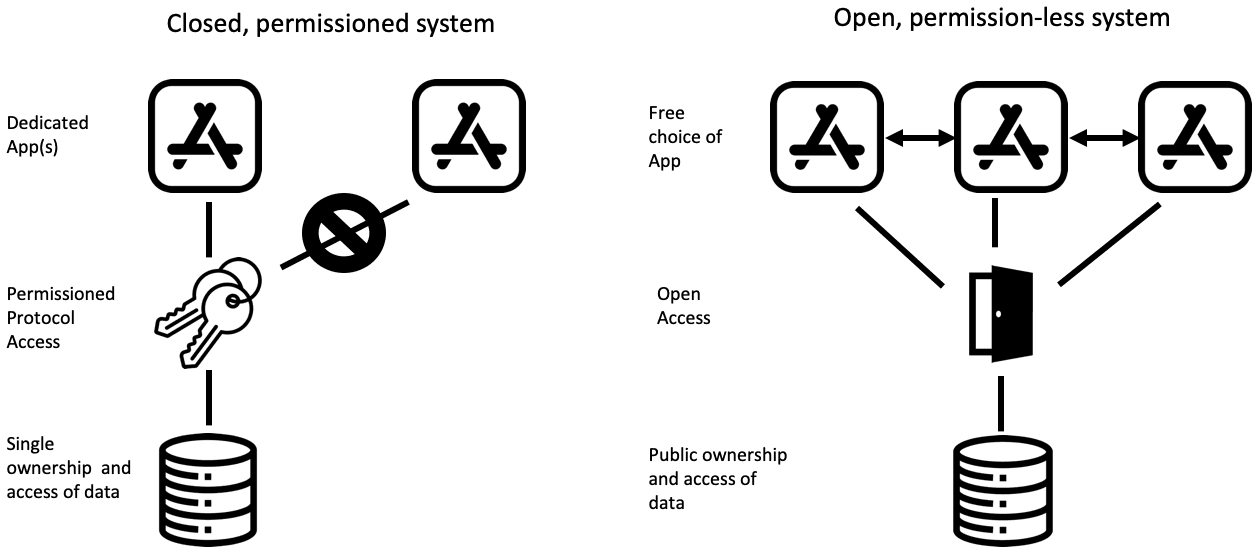

Today, companies not only own and operate the applications we use to access a given protocol (such as a social protocol — Instagram is a good example), but they also dictate access permissions and retain ownership of all the underlying data. Users need to trust that the company will continue to keep hosting the application, protocol, and data.

Open blockchains disrupt this business model by allowing anyone to deploy an application on the protocol and leverage the underlying data. Furthermore, applications are interoperable as they are leveraging the same messaging protocol. This is what enables different Bitcoin wallets to easily transfer bitcoin between them. The same architecture could be applied to build, for example, an open messaging layer, enabling different messaging apps to send messages between them. As no central party is governing the system, the risk of losing protocol access ceases to exist and censorship is not possible. The immutability of the blockchain ensures that data cannot be lost, altered, or removed.

You could argue that the big tech companies of today are particularly at risk of being dis-intermediated by blockchain-based applications. Providing universal access, and ensuring the data remains in the hands of its users, is certainly a compelling value proposition.

Unfortunately, blockchain networks are still in their infancy and are not yet capable of delivering a comparable service to the millions (or billions) of people currently using the various platforms owned by big tech. Today’s blockchains face difficulties with scaling, especially while trying to maintain a high degree of decentralisation. This is why a lot of current use cases are being built on DLT systems, which accept tradeoffs in order to scale quickly and improve efficiency. It remains to be seen whether blockchains will be capable of remaining truly decentralised while also being secure, able to operate at scale, and execute with high speed.

A version of this article was originally published by Bankless Publishing on June 8, 2022.

Author Bio

The Crypto Barista is a new writer at BanklessDAO. Besides his passion for brewing with the finest espresso beans, he loves being at the forefront of innovation and enjoys teaching about blockchain and digital assets.

Editor Bio

Trewkat is a writer and editor at BanklessDAO. She’s interested in learning as much as possible about crypto and NFTs, with a particular focus on how best to communicate this newfound knowledge to others.

Designer Bio

pub-gmn.eth is a blockend developer.

BanklessDAO is an education and media engine dedicated to helping individuals achieve financial independence.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Bankless Publishing is always accepting submissions for publication. We’d love to read your work, so please submit your article here!

Other Articles In This Series

Coming soon