How Identity and Utility Drive Value in Non-Fungible Tokens

Article by Lanz | Edited by Trewkat | Cover by ab-colours

Welcome to Bankless Publishing’s Crypto Basics Series. We’ll be shipping all of our introductory web3 content on Mirror each Monday, enabling users to curate a web3 reference library by minting NFTs on Optimism.

“We have tons of digital stuff, we just never really owned it” – OpenSea

The hype around non-fungible tokens (NFTs) is too big to ignore, evident from the 40 billion USD valuation of the NFT market on the Ethereum blockchain in 2021. This figure excludes NFTs minted on other blockchains, like Solana and Tezos. OpenSea, the largest NFT marketplace, regularly sees trading volume greater than 2 billion USD per month. Like many, I was initially skeptical about the appeal, but after spending some time learning about the NFT space, I do see the potential.

To understand why anyone would pay 200,000 USD for a cartoon ape or even 30 USD for a walking fish gif that anyone can just right-click and save for free, I started with this question: why do we own what we own? It boils down to two things: utility and identity.

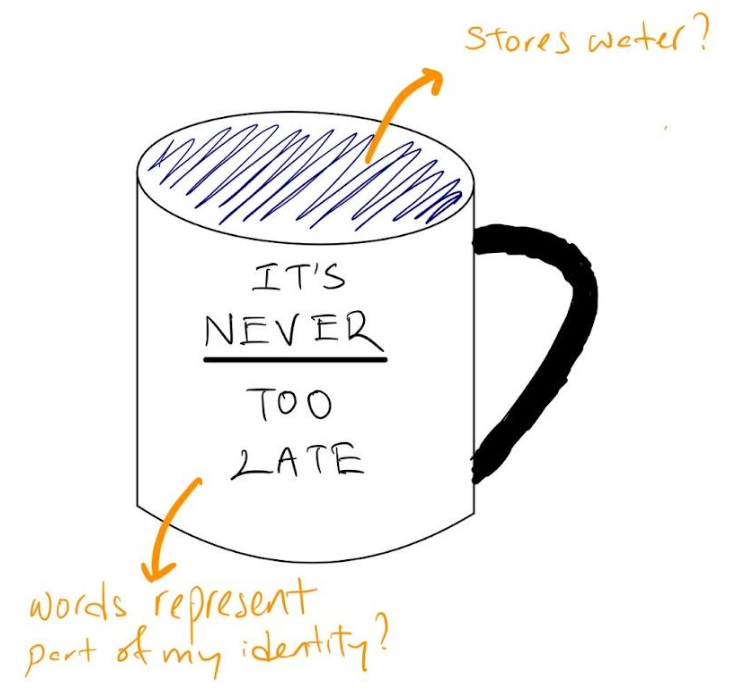

Meet Mug, my desk buddy for 5 years.

Take my mug for example. I bought it because I needed something to drink from without having to visit the office water cooler every time I was thirsty. It holds liquid — that’s its utility.

I could’ve just got any mug but I chose this one in particular because the motivational quote written on the side is my mantra: It’s Never Too Late. It builds on the identity I’ve created for myself. Utility meets identity.

It’s the same for real estate. A property offers immense utility such as being a shelter or generating passive rental income. Other aspects of the property, like the interior design and location, are extensions of the owner’s identity.

While we are familiar with owning tangible assets like mugs or real estate, the idea of owning intangible assets is relatively new. Intangible assets like patents and trademarks were only formally recognised as an asset in the last two decades in accounting, when financial analysts realised excess profits were being made without physical assets. This concept of intangible property ownership applies to NFTs too.

So, What Are NFTs?

NFTs are tokens that represent ownership of unique digital content as recorded on a blockchain like Ethereum or Tezos. Owning an NFT means you have blockchain-based proof that you own a particular piece of digital content. The concept is best explained by breaking down the term into its constituent parts: fungibility and tokens.

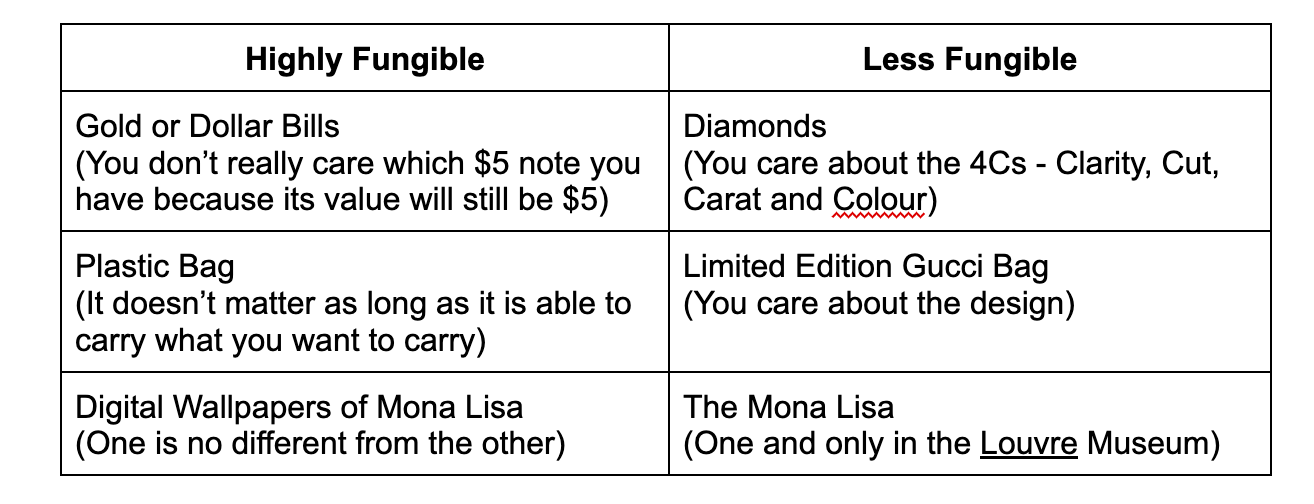

Fungibility means replaceability. A fungible item suggests homogeneity, that one thing can easily be replaced by another. Conversely, a non-fungible item suggests uniqueness. It is not easy to substitute for a non-fungible item. Here are some examples:

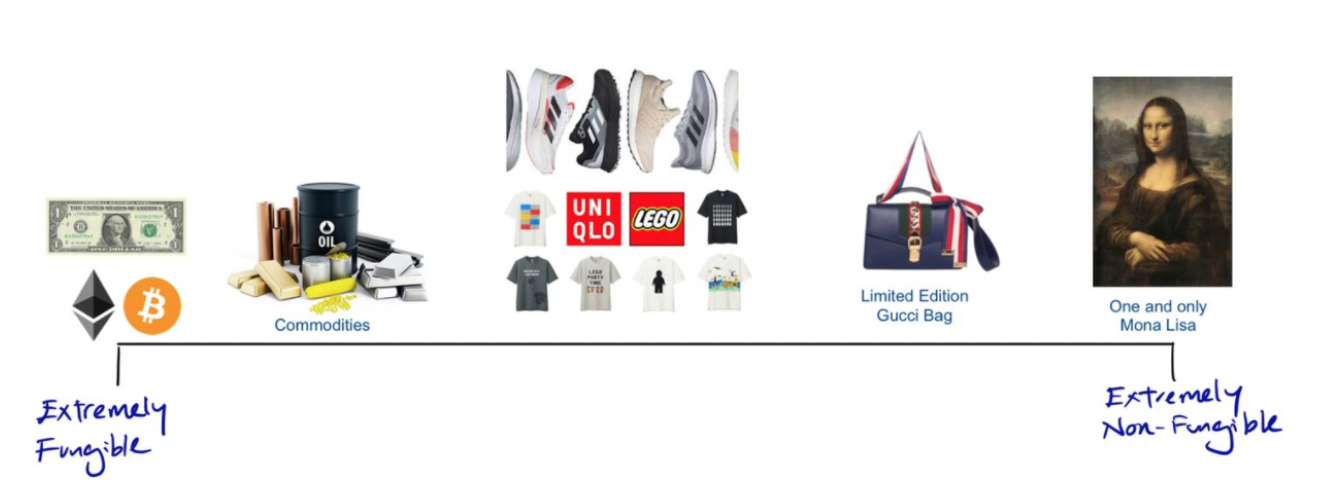

Fungibility can be viewed on a spectrum, as illustrated:

There is only one original Mona Lisa portrait painted by Leonardo Da Vinci in 1503, which makes it extremely non-fungible. Gucci however, could decide to sell 10 copies of their limited edition designer bags, which makes it more fungible than the Mona Lisa. Currency tends to be very fungible.

Tokens are units of value that organisations or projects deploy to existing blockchain networks. In the case of NFTs, the token represents digital ownership and authenticity of a certain item. NFT ownership is facilitated through smart contracts which ensure that there’s only one owner per token.

NFTs are created through a minting process via a smart contract which, in simple terms, is like timestamped instructions saved on the blockchain. The contract records the details of the digital object, the terms associated with it, and the original creator. If and when a transaction is initiated, it triggers the smart contract to transfer the ownership from one wallet to another. This transaction will be recorded on the blockchain, meaning there is a decentralized public ledger to track ownership.

It’s important to note that the NFT itself is usually just a code stating ownership. This means the actual digital content is not stored on the blockchain but hosted via an off-chain storage provider.

This could be decentralised like the Interplanetary File System (IPFS), or simply held on the creator’s own server or AWS.

The digital content is accessed via the link stored within the NFT metadata. Developer Geoffery Huntley illustrated this concept with his project The NFT Bay, a site similar to Pirate Bay that hosts all the NFTs on the Ethereum and Solana blockchains. I highly recommend reading his FAQ on GitHub as he demonstrates how most NFT media storage works.

The NFT Ecosystem

Currently, the common use cases for NFTs are collectibles, art, and gaming. Other applications to look out for include proof of attendance for events (e.g. POAP) and domain names (e.g. ENS). I believe there will be more use cases for digital and even physical assets going forward, in areas like event ticketing and real estate.

As I dived deeper, I realised that the stakeholders within the NFT ecosystem are much more comprehensive than what I had imagined, as seen in this NFT stack by Messari:

Here’s a summary of what each layer represents:

-

Layer 1 Infrastructure: The fundamental network layer and core architecture that enables the NFTs’ smart contracts. Also known as the mainchain or mainnet, examples include Ethereum, Solana, and Tezos. Without this, there is no NFT.

-

Layer 2 and Sidechains: Scalability solutions for Layer 1, which are designed to offload the work from the main chain through different scaling methods. Layer 2s are like flyovers built on congested expressways; they enable faster and more efficient transactions.

-

Storage: The AWS or Google Drive of Web3. Given the lack of capacity within the actual blockchain (Layer 1s), most NFT data (e.g. the art) are stored elsewhere.

-

Verticals and Applications: Interfaces that encourage use of the tokens created in Layer 1s and 2s. These include games or virtual worlds.

-

Financialisation: Using NFTs for performing financial practices. Some use NFTs as collateral to borrow. Others partake in fractionalising valuable NFT pieces (like CryptoPunks) into smaller stakes held by more people. The concept of fractionalised NFTs is like buying shares of a public company.

-

Aggregators: Marketplaces like OpenSea and Rarible, where there’s a big pool of buyers and sellers available.

-

Front Ends and Interfaces: Where individuals display their artwork — an art studio exhibition of sorts.

What’s In It For Buyers?

Given the depth of the NFT ecosystem, there are many reasons why people would buy an NFT, but I believe these can ultimately be distilled to the twin pillars of ownership: utility and identity.

1. Social Status (Identity)

For better or worse, we are likely to spend more and more time within the digital sphere. In the physical world, we are always on the lookout for ways to differentiate ourselves and cement our status. This behaviour projects into the digital world, with an emerging market for luxury-equivalent assets as we shape our digital identity.

An example is Bored Apes Yacht Club (BAYC), one of the most valuable NFT projects that started out as a set of 10,000 profile pictures.

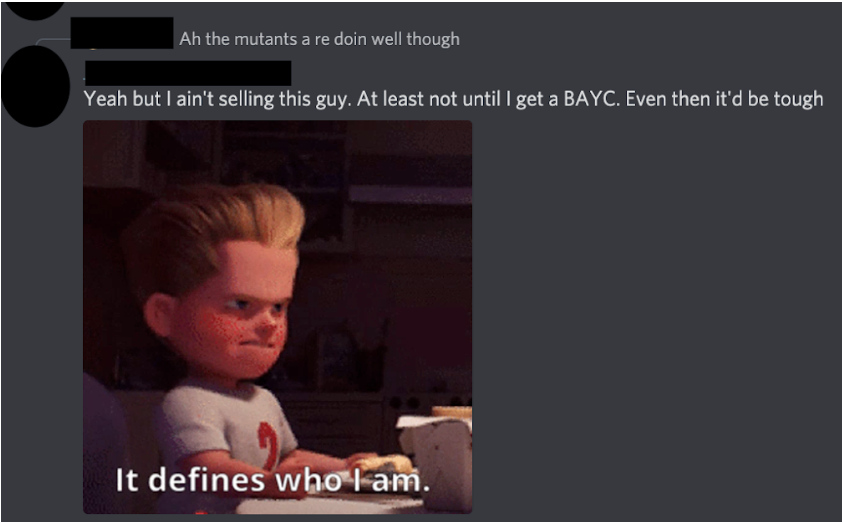

In a discussion by Shiv Socrates Kapoor on what it means to own a Bored Ape, this stands out: some NFTs “can be understood as digital Veblen goods that confer status upon the bearer/owner. The act of buying one is the ultimate digital flex in some online communities”. At its current floor price alone, owning a Bored Ape is definitely a flex.

But it’s not merely a flex. You don’t just own a Bored Ape; you become one. Buying Bored Ape #1455 gives you that identity on Web3. It doesn’t matter if you’re an accountant or a janitor in real life; in this instance, digital identity takes precedence.

A JPEG as a luxury good may seem far-fetched, but there are parallels that hint this is here to stay. Top-grossing games like Fortnite and Free Fire generate billions of dollars in revenues from cosmetic items like costumes and game skins. People are willing to pay for pure hedonic pleasures derived from making their characters look good.

2. Community Membership (Utility)

For successful projects, the purchase of an NFT goes beyond just buying that digital content. In this space, it’s not just about the art. Community engagement is key to growing and sustaining any NFT project. Creators and their teams have to be constantly online (on Twitter and Discord) to engage with their communities, which include people living in different time zones.

Good creators hold events, pre-sales, and other activities for token holders. Great creators bring these events to the real world. One example is BAYC’s Ape Fest where BAYC holders from around the world gathered for a night of fun and networking.

This is similar to traditional networking clubs (e.g. Entrepreneur Organisation) where you pay a membership fee to socialise and attend events with other influential entrepreneurs. As BAYC co-founder Gargamel puts it, “Your Ape is your Amex Black Card”.

3. Intellectual Properties (IP) and Commercial Rights (Utility)

IP and commercial rights remain a grey area within the NFT space. These vary from project to project, depending on the stated terms and conditions. There are NFTs (e.g. BAYC) that confer full IP rights to token holders while others (e.g. CryptoKitties, CryptoPunks) confer licensee rights.

NFT holders conferred with full IP rights can monetise their IP in ways similar to the way Disney monetises their various IP characters through merchandise. According to crypto commentator economist:

“This has created a recognizable platform that Bored Ape Yacht Club token holders can use as a launchpad for their own projects. If you were a part of the community in early May, you were expecting everything from merchandise, coffee, glassware, games, and more — an ecosystem within the ecosystem.”

There are no official statistics to show the popularity of the merchandise, but with BAYC’s popularity growing into the mainstream, sales from BAYC merchandise will most likely grow.

However, most NFTs do not give full rights like BAYC. Licensee rights usually come with a revenue cap (e.g. $100,000 per year) from the sale of merchandise. There are also projects that limit usage of NFTs to personal, non-commercial use.

It’s best to clarify with the project founders and/or lawyers regarding the various IP implications prior to your purchase of an NFT if your intent is to ride on the wave and make money off commercialisation. (Some useful resources regarding the legal aspects of NFTs can be found here and here.)

4. Collectibles (Identity)

For collectible NFTs, there’s an emotional and sentimental aspect to purchasing. Examples include the first-ever Disney NFTs on VeVe and NBA Top Shot on Flow blockchain.

For an avid Disney fan, it’s not hard to see the appeal in owning the first set of limited edition Disney NFTs, as it’s similar to owning original Disney merchandise.

Are You Buying An Asset?

NFTs are commonly referred to as digital assets, but are they really?

Traditionally, assets are defined as a resource controlled by the owner as a result of past events and from which future economic benefits are expected to flow to the owner. To break it down in the context of NFTs:

-

Resource Controlled By the Owner: What an NFT owner controls depends on the terms of sale for the particular NFT. The onus is on the NFT owner to understand these terms and know what they own. While some of these terms are baked into an NFT’s smart contract, most terms will likely be off chain on a separate website. The difference is crucial because off-chain terms will not be enforceable by smart contracts and will require separate legal remedies. This means the owner does not have full control of the resource.

-

Future Economic Benefit: The strict definition of future economic benefit requires the asset to be cash generative. The only way for it to be recognised as an asset is if it was purchased as an IP for commercial purposes. However, a broader definition would also consider the non-economic benefits NFTs might bring, like social status and community membership. These benefits may prove to be more important than economic benefits to the NFT owner.

Given the diversity and fluctuations in the NFT space, I believe that only the owner of the NFT can decide on whether it is an asset.

How NFTs Benefit Creators

While the rationale for buying NFTs might be hard to comprehend, the appeal of NFTs to creators is much more straightforward:

1. Resale Royalties

When it comes to NFTs, smart contracts are built in a way that creators get perpetual royalties from all resales of their work. This is a game changer.

In the current art market, most artists will only get money from their initial sale and none from the resale of their work. Even for million-dollar art pieces sold at high-end auction houses, artists generally do not get anything from these sales.

This leads to a fundamental misalignment of interests: artists have no tangible incentive to promote their work beyond the initial sale. In contrast, there are incentives for NFT artists to continuously promote their work and enhance their brand, which benefits both the artist and the current owner of the work.

2. Better Reach and Liquidity

Art is traditionally a highly illiquid and opaque market, often transacting through major auction houses. With NFTs, artists are able to bypass these auction houses with online marketplaces. They are able to reach larger audiences, AND keep a larger cut of the sale. These marketplaces also serve as a liquid market for artists to gauge the popularity and value of their work.

3. More Control

NFTs give creators more control over the sale of their work. They call the shots on business decisions, such number of copies for distribution, sale price, and the IP rights they want to give buyers. They are also able to shape their personal brand and forge closer relationships with their collectors.

Empowering Ownership, Not Restricting Access

The idea of ownership is one of the core ideals and ethos of Web3. NFTs are meant to empower ownership, not to restrict access. I believe much of the digital content we have today will continue to be free to consume (or delivered at low cost like Spotify), but only a limited number of verifiable owners will exist. This is no different to how we can easily see a picture of the Mona Lisa online but the real deal in the Louvre is still worth a ton.

While I see the vast potential of NFTs (especially for creators), we are still early in the process of encouraging digital content ownership. The NFT space currently is awash with speculative money, volatility, frauds, and scams. Rug pulls, the act of abandoning a project after obtaining funds, are occurring on almost a daily basis. However, I believe these are solvable problems when better governance measures, either in the form of regulations or best practices, are put in place.

I foresee enormous value being unlocked by NFTs, once we get past the speculative phase. As the NFT community puts it, WAGMI.

A version of this article was originally published by Bankless Publishing on May 4, 2022.

Author Bio

Lanz is a filmmaker exploring Web3. She’s currently building Migrants NFT — a community initiative to bring art and stories from the migrant worker community on to Web3.

Editor Bio

Trewkat is a writer and editor at BanklessDAO. She’s interested in learning about applications for blockchain and NFTs, with a particular focus on how best to communicate this knowledge to others.

Designer Bio

ab_colours is a versatile designer with over seven years of experience. He specializes in doing product design, UX design and brand identity. He has been DAOing for the past eight months and has been able to amass quite a lot of knowledge about the fascinating blockchain space.

BanklessDAO is an education and media engine dedicated to helping individuals achieve financial independence.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Bankless Publishing is always accepting submissions for publication. We’d love to read your work, so please submit your article here!

Other Articles In The Crypto Basics Series

Decentralized Ledger Technology 101 by The Crypto Barista